|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Home Refinance Calculator with Cash Out: A Comprehensive GuideRefinancing your home with a cash-out option can be a strategic financial decision, but it's essential to understand the implications and benefits. A home refinance calculator with cash out is a valuable tool that helps you determine the potential outcomes of refinancing your mortgage while taking out cash from your home's equity. What is a Cash-Out Refinance?When you opt for a cash-out refinance, you replace your existing mortgage with a new one, usually for a larger amount. This new loan pays off your old mortgage, and you receive the difference as cash, which you can use for various purposes. Benefits of Cash-Out Refinancing

How Does a Home Refinance Calculator with Cash Out Work?The calculator helps you estimate your new loan amount, monthly payments, and the cash you can receive. It considers factors such as your current loan balance, home's value, and desired cash-out amount. Steps to Use the Calculator

Understanding the cost to refinance a mortgage is crucial when considering this option. Considerations Before RefinancingWhile a cash-out refinance can be beneficial, it's important to consider the following:

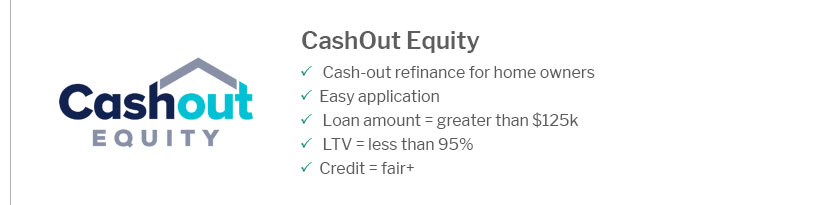

Finding the Best LenderResearching top 10 refinance mortgage companies can help you find competitive rates and terms that suit your needs. Frequently Asked QuestionsWhat is the primary advantage of a cash-out refinance?The primary advantage is gaining access to cash from your home's equity, which can be used for various financial needs. How much cash can I get from a cash-out refinance?The amount depends on your home's value, existing mortgage balance, and the lender's policies, typically up to 80% of your home's appraised value. Are there risks associated with cash-out refinancing?Yes, potential risks include higher interest costs over the life of the loan and the impact on your home equity. By utilizing a home refinance calculator with cash out, you can make informed decisions that align with your financial goals and needs. https://clark.com/mortgage-refinance-calculator/

Clark's Breakeven Rule: This calculator is built to give advice based on Clark Howard's 30-month breakeven rule for mortgage refinancing. Clark believes that ... https://www.zillow.com/mortgage-calculator/cash-out-refinance/

Zillow's cash-out refinance calculator can help you determine if taking cash out of your home equity is the right choice for you. https://www.midflorida.com/resources/financial-calculators/cash-out-refinance-calculator

Looking to Borrow Money Against Your Home's Equity? - Current home value - Desired cash-out amount - Current mortgage balance - Interest rate - Monthly payment.

|

|---|